how to pay indiana state withholding tax

Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check money order and debitcredit cards fees apply. Have more time to file my taxes and I think I will owe the Department.

2020 Minnesota Minnesota Income Tax Withholding Download Printable Pdf Templateroller

The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees.

. Withholding payments must be made to DOR by the due dates or penalties and interest will be assessed. Payment of withholding tax is made online using iTax which generates a payment slip that must be shown at any of the designated KRA banks in order to pay the tax owed to the KRA. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

Any money withheld must be remitted to KRA by the 20th day of the next month unless otherwise specified. Find Indiana tax forms. Indiana uses the taxpayers federal adjusted gross income to calculate the amount of state tax owed.

How to Report Indiana Gambling Winnings to the IRS. To register for Indiana business taxes please complete the Business Tax Application. Enclose your check or money order made payable to the Indiana Department of Revenue.

Multiply the taxable income computed in step 4 by 323 percent to obtain the annual Indiana tax withholding. Have more time to file my taxes and I think I will owe the Department. The payees tax resident certificate issued by the tax authorities of the nation in which the payee resides is.

Credit card payments may be made through the Ohio Business Gateway OBG or over the Internet by visiting the ACI Payments Inc. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. There is no additional penalty beyond the federal penalty for early withdrawal from an IRA in the state of Indiana.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Youll enter that extra amount on Line 4c Extra Withholding of Form W-4. Pay my tax bill in installments.

There may be penalties for not paying enough federal andor state income tax during the year. Pay the amount due on or before the installment due date. Because of this the addition of funds to an IRA lowers the taxable income and the withdrawal of funds increases it.

FEDERAL TAX WITHHOLDING PERIODIC WITHDRAWALS Withholding is voluntary from Lifetime Annuity certain Fixed Periods Minimum Distribution Option and other. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165. When completed correctly this form ensures that a businesss withholding taxes by county are reported accurately and timely.

A refund of withholding tax overpaid by a payer as a result of the DTA decreased rates must be requested by the payer in writing which must be sent to the Director Non Resident Branch of the Internal Revenue Service along with the following information. Know when I will receive my tax refund. Know when I will receive my tax refund.

You can also make your estimated tax payment online via INTIME at intimedoringov. But in general there are two main pages to the IT-40 Indiana full year resident returnYou will sign the second page of the IT-40 and place all other pages of the tax return behind it. The full amount of tax you owe is more complex than multiplying your income by your federal tax rate state local and FICA taxes also apply.

If you get the W-2G from the payers of your winnings its a simple process of adding up. Claim a gambling loss on my Indiana return. Take the renters deduction.

You can use your American Express DiscoverNOVUS MasterCard or Visa credit card to pay your withholding tax liability. Payments can also be made using Mpesa. All payments must be made with US.

You can pay those Indiana state taxes due directly online to Indiana at the web site address here select Individual Tax Return. Write your Social Security number on the check or money order. Find Indiana tax forms.

Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. Divide the annual Indiana tax withholding by 26 to obtain the biweekly Indiana tax withholding. In general though higher earners will always have a higher tax liability.

Tax Rates by Income. Your winnings that are subject to federal income tax withholding either regular gambling withholding or backup withholding. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

The IRS requires you to report the total of your all qualifying gambling winnings for the year on a Form 1040. Take the renters deduction. The aggregate of Indian state income tax and local tax applicable in a county within the state of Indiana are taken along with the allowed personal exemption and exemption for dependentsYou can also check federal paycheck tax calculator.

2 Number of exemptions claimed for certain qualifying dependents. There is a service fee charged by ACI Payments Inc. Claim a gambling loss on my Indiana return.

INTAX only remains available to file and pay special tax obligations until July 8 2022. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax. There are several ways you can pay your Indiana state taxes.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Additional Allowance 1500 x Number of Additional Exemptions 2. However if not completed correctly there is a.

If you do not file a return and pay the proper amount of tax you will face criminal prosecution for fraud or tax evasion. If you are required to withhold federal taxes then you must also withhold Indiana state and county taxes. Pay my tax bill in installments.

A representative can research your tax liability using your Social Security number. If you are mailing your Indiana return the complete filing instructions should print with your state return including the address to mail. Federal and state tax withholding rates are always subject to change.

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms Chart State Tax

Calculating Your Withholding Tax Inside Indiana Business

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

State W 4 Form Detailed Withholding Forms By State Chart

What Are Payroll Taxes And Who Pays Them Tax Foundation

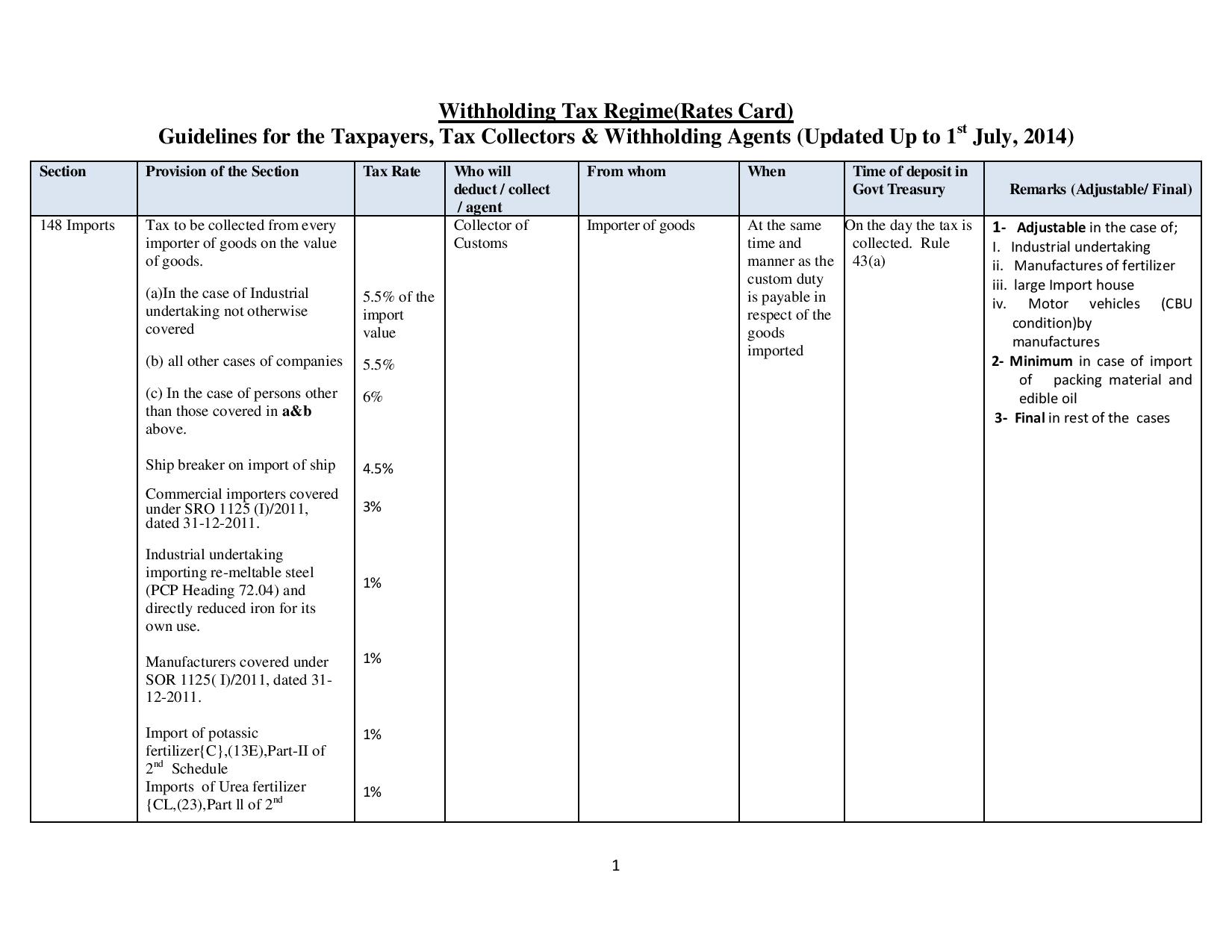

Fbr Issues Withholding Tax Rate Card For Fiscal Year 2014 2015 Customsnews Pk Daily

Pass Through Entity And Trust Withholding Tax

Trump S Proposed Payroll Tax Elimination Itep

2022 Federal Payroll Tax Rates Abacus Payroll

Cwt Definition Creditable Withholding Tax Abbreviation Finder

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

State W 4 Form Detailed Withholding Forms By State Chart

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)